Are your clients quietly disappearing, leaving you wondering why your churn rate is rising? Are you struggling to maintain loyal clients and keep them satisfied? Retaining clients and building their loyalty is as important as acquiring new ones.

Effective invoicing strategies are a fundamental part of building a solid customer base. Billing is an intimate part of the customer journey, where clients need to feel safe. A lack of transparency can scare them away from further collaborating with your company. So, how can you use billing strategies to build strong and lasting client relationships? Let’s look into the top 9 invoicing strategies to ensure your business will not lose any other customers!

9 Top Invoicing Strategies to Cut Churn

Learn how to effectively cut churn by improving the billing process with several proven strategies vital for your success:

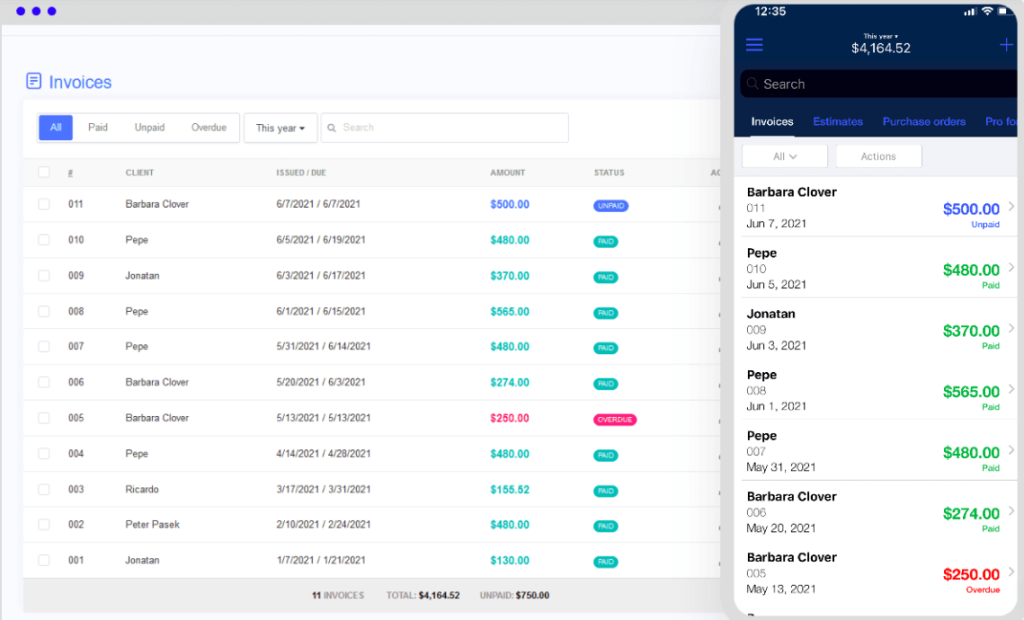

1. Digitize and automate your invoices

Invoice automation is one of the most potent and revolutionary billing strategies. But why is workflow automation so essential?

Businesses that process their invoices manually spend 14,6 days doing so on average. Also, 39% of invoices contain errors. So, the manual billing process is not only time-consuming but also prone to mistakes.

Your business can face this issue using invoice automation software. It will allow you to decrease the processing time, optimize financial streams, and minimize human errors.

The billing software provides insights into your cash flow and financial analytics. It will help you to make informed decisions and effectively cut customer churn.

2. Personalize your invoices

The personalized invoice template is a valued strategy due to its ability to strengthen customer relationships and lower churn. How?

A personalized approach assures your customers that they are more than just a transaction. It makes them more likely to develop an emotional connection with your brand and not seek alternatives.

Templates allow you to create customized invoices and facilitate on-time payments, but is it that simple?

The likelihood of quick payment increases when businesses use tailored invoices, including specific information (client name, purchase history, etc.). Clients feel valued by your sense of detail, and their willingness to pay quickly and stay loyal to your company in the future increases.

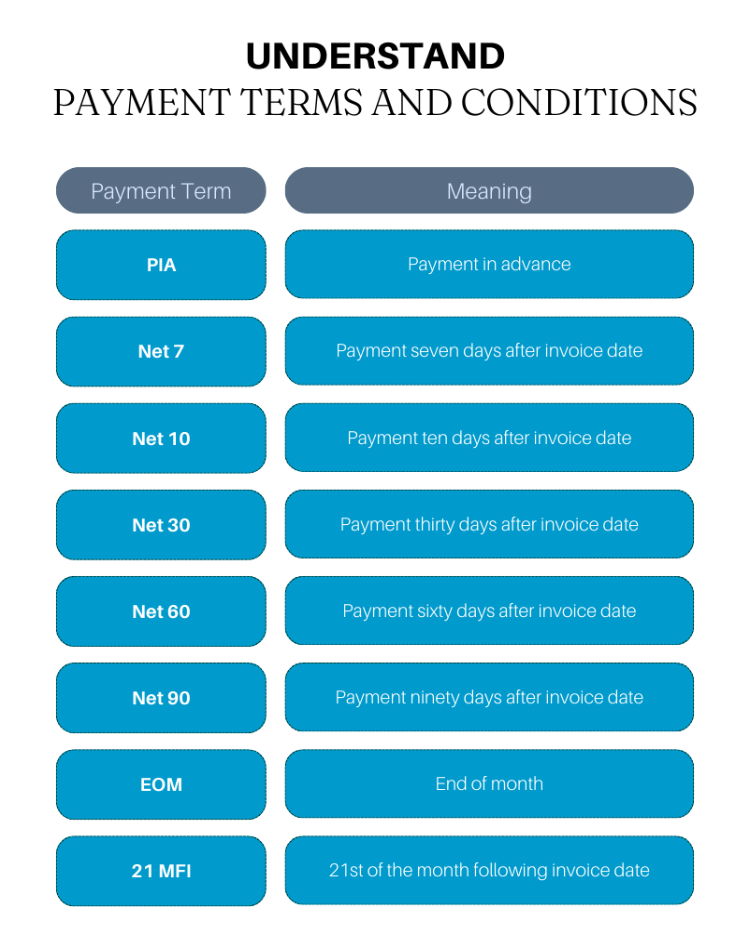

3. Set clear payment conditions beforehand

Are you losing customers due to payment issues? When your clients receive an invoice, is it clear when or how to pay?

Setting clear payment conditions beforehand is vital to deal with this problem. If there is room for confusion, your clients may seek more transparent alternatives, and your churn rate will grow.

This invoicing strategy aims to eliminate uncertainty and ease the payment process. But why is clarity important? Confusion about finances might lead to friction or delayed payments, and force your clients to refrain from your company. So, become a proactive company and set clear payment conditions at the beginning.

4. Make your invoices simple and clean

To achieve stable growth, one of the most effective invoicing strategies is the simplicity and cleanliness of your invoices. Are your invoices organized, and essential details, such as total payment amount or due date, clearly visible?

Simplifying invoices can help you reduce the churn rate. Complicated invoices can lead to misunderstandings and disappointment. On the other hand, clean and transparent invoices allow customers to quickly understand when and how they should pay.

This minor adjustment can have a significant impact on customer satisfaction and retention. Review and clarify your invoices and see your clients coming for more!

5. Use SMS payment reminders

Is it common for your clients to forget to pay the bills? In the digital age, their email folders are getting overwhelmed, and it is easy for your invoice to get lost. Do not rely solely on email notifications; be proactive and remind them with SMS, leveraging SIP trunking technology to ensure seamless and cost-effective communication.

How can SMS payment reminders make a difference?

It is a prompt channel that facilitates immediate communication between you and your client. The main benefit of SMS payment reminders is their convenience. People tend to check SMS more frequently than emails, so SMS reminders are highly effective. In addition, automatically sending SMS adds a personal touch, showcasing commitment to their satisfaction.

6. Strategically schedule your invoices

Strategic scheduling of invoices can work wonders for your business. When you plan your invoices, you provide your clients with financial predictability. Your clients will know when they are expected to pay, and you will show your interest in their well-being.

A healthy and predictable financial flow is also essential for the stability of your company. Strategic planning reduces the likelihood of missed or delayed payments and increases satisfaction among your clients.

7. Monitor your cash flow

Are you regularly keeping track of your income and expenses? Monitoring your financial flow is one of the most successful billing strategies to reduce churn. Why is your healthy cash flow necessary for your clients?

Financial obstacles of your business directly affect the customers. Unsupervised cash flow can lead to delayed services and reduced customer satisfaction. You need a clear picture of when you receive payments to meet your financial obligations.

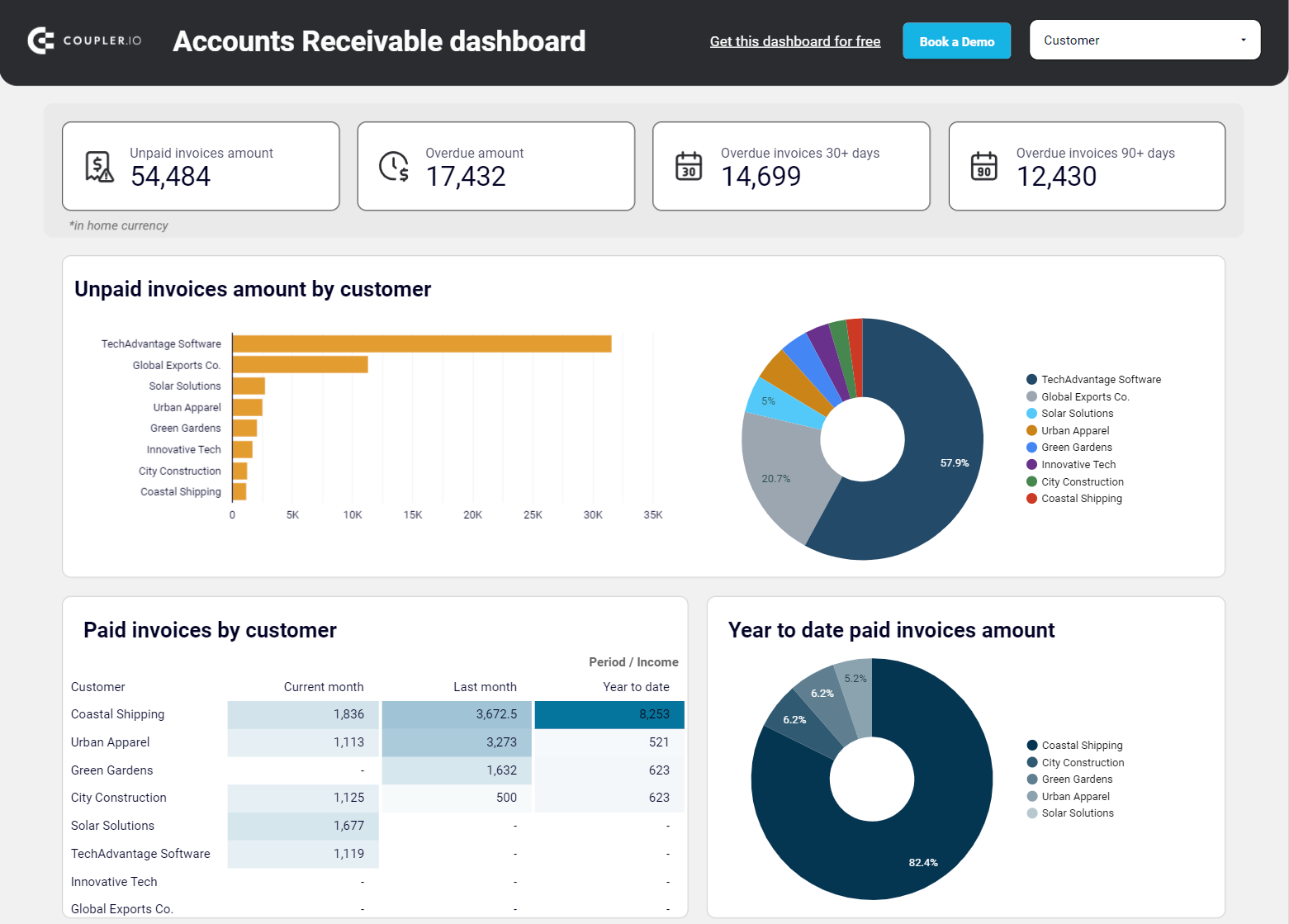

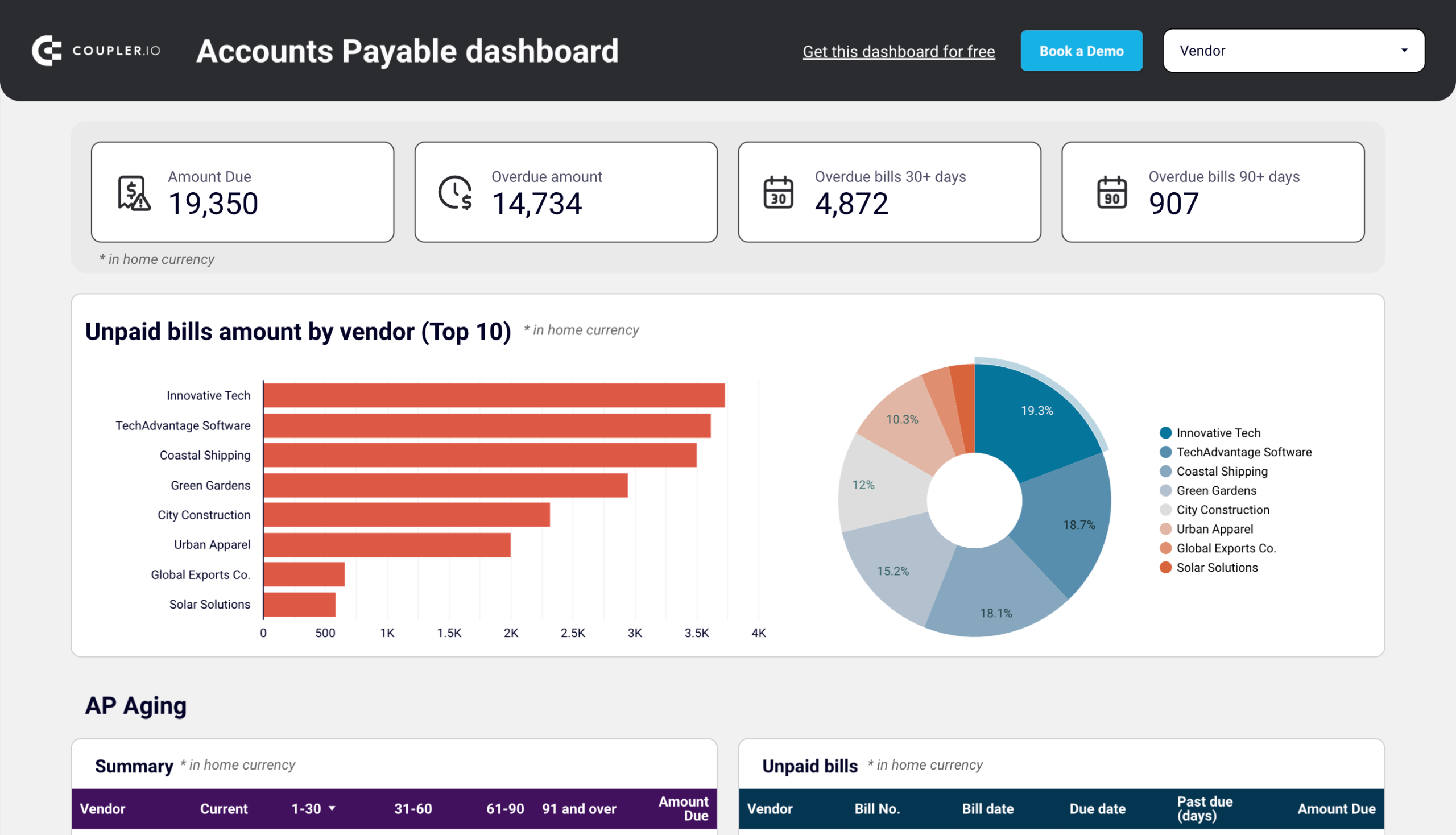

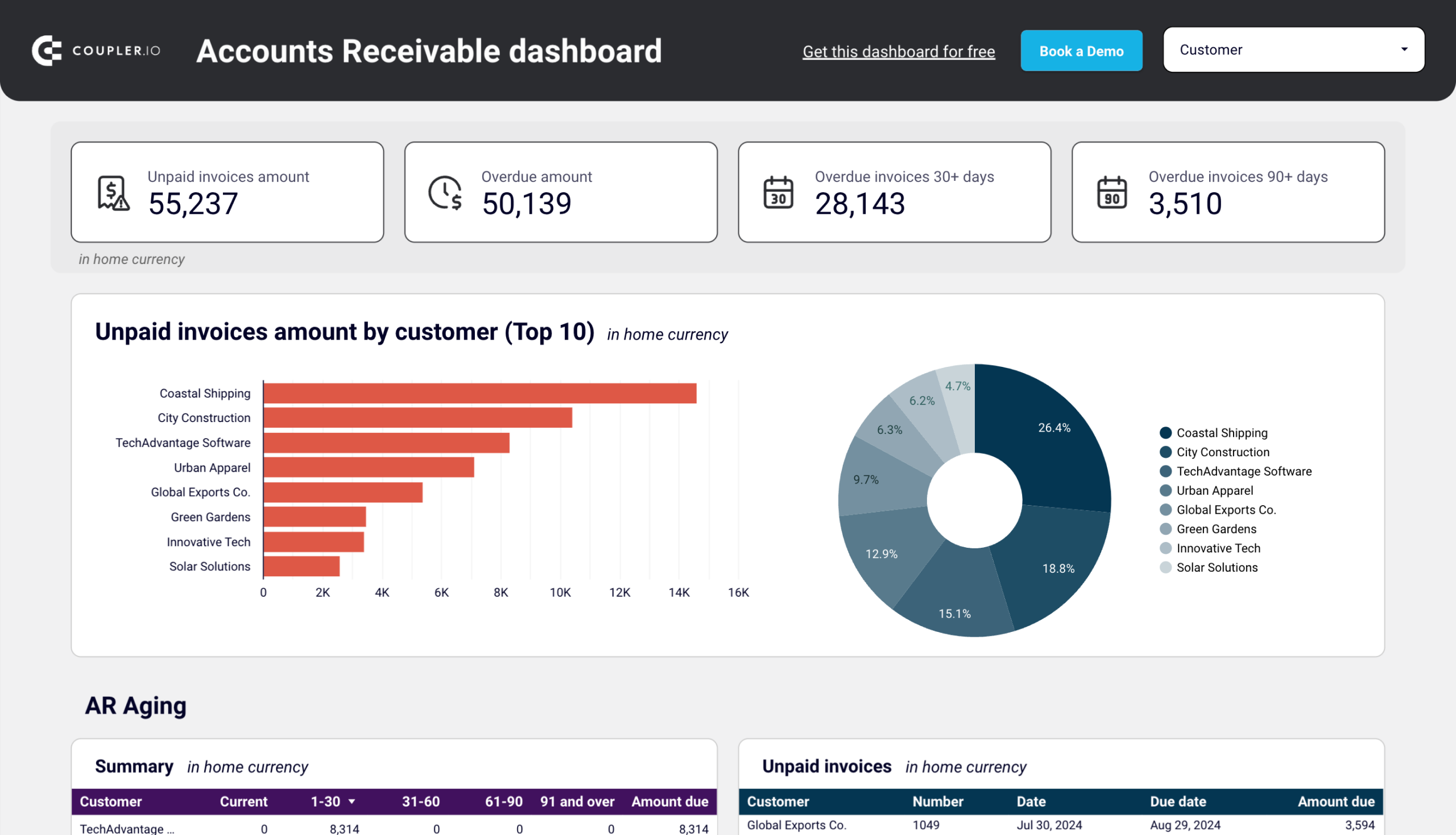

The accounting software such as QuickBooks or Xero usually offers basic reports to monitor cash flow. However, they are pretty general and are always limited if you want to get deeper insights. Not to mention the inconvenient shareability. As a rule, you need to export a report as a CSV or Excel file to share it with stakeholders.

An alternative solution that lacks all these limitations is to use cash flow dashboards. These are predesigned financial analytics solutions that usually accommodate several reports.

Coupler.io, a reporting automation and analytics platform, allows you to create custom financial reports and offers white-label templates for Xero, QuickBooks, and other tools. They are free and equipped with a built-in connector that automates data load from your accounting software to the dashboard.

The financial stability of your company is a must to accommodate the expectations of your clients and build trust. Therefore, monitoring cash flow and financial analytics is a must for every successful business.

8. Offer flexible payment options

Providing various payment options is an excellent invoicing strategy that increases customer retention. Giving your clients the freedom to choose how to pay can significantly boost their satisfaction, making them more likely to repeat transactions with you in the future.

In addition, allowing different payment methods reduces the risk of late payments. This approach significantly impacts customer churn by catering to the client’s needs.

9. Reduce billing disputes

Lastly, a billing strategy to prevent your clients from seeking alternatives is reducing billing disputes. Do your billing strategies frequently lead to disagreements?

The most common cause of disputes is complicated invoicing. Is it possible to effectively reduce dissatisfaction and arguments with your customers?

Tips to effectively reduce billing disputes:

- As mentioned before, make your invoices clean, simple, and easy to understand.

- Maintain clear documentation of each transaction and handle disputes effectively.

- Be in direct contact and communicate transparently to prevent misunderstandings.

- Present your company with a professional invoicing process using the strategies mentioned earlier.

Why is customer satisfaction important?

Customer satisfaction measures how well you meet your client’s expectations and how happy they are with your company’s offerings.

Customer churn is a counterpart of client satisfaction and retention. The churn rate represents the number of clients who leave your business and seek alternatives.

To make your company grow sustainably, it is essential to decrease the churn rate as much as possible. So, what are the main benefits of a low churn rate for your company?

| Benefit | Explanation |

|---|---|

| Customer Retention | Satisfaction leads to repeated transactions and loyalty. |

| Word of Mouth Marketing | Sharing positive experiences increases organic growth. |

| Cost-Efficiency | Retaining existing customers is less expensive than attracting new ones. |

| Competitive Advantage | A solid and satisfied customer base distinguishes you from other companies. |

| Revenue Growth | Higher satisfaction often leads to higher spending and higher profit. |

| Customer Forgiveness | Loyal clients forgive minor issues more quickly than new ones. |

| Strong Online Reputation | Positive online reviews help to acquire new customers. |

| Business Sustainability | Client satisfaction is the key to building a sustainable, growing company… |

How do invoicing strategies affect customer churn and satisfaction?

Precise billing strategies are essential for building a safe environment and transparency, maintaining healthy cash flow, and reducing errors. The key to a transparent billing process is communication and being available to clients immediately.

We’ve consulted Billdu invoicing software experts to clarify the effect of billing strategies and shed light on the process:

Transparent billing makes customers feel safe and less open to seeking alternative services, effectively reducing churn. You will maintain a healthy financial flow and build trust by implementing understandable invoices and payment reminders. This approach ensures payments are made on time and solidifies client relationships, increasing their retention and overall happiness. – Erik Hudák, CEO at Billdu

Final thoughts: Fostering long-term customer loyalty

Handling customer churn is challenging for each company, but it can be addressed effectively through specific invoicing strategies. A consistent, simple, personalized billing sends a clear message to your customers: you are committed to their satisfaction. The invoicing process should resonate with your clients, making them feel safe and willing to go through it again.

Correct use of billing strategies fosters trust, reduces the need to seek your competitors’ services, and improves your business’s cash flow. After all, a successful company is one with a loyal and growing customer base that will stay with you year after year, scaling up your business operations.